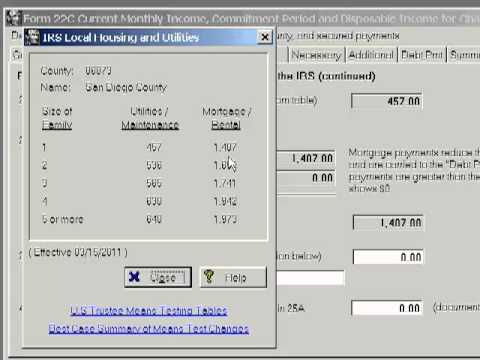

Hi there, this is Victoria. In this lesson, I'm going to show you a problem that exists quite frequently. It's the balancing of schedule J with the means test for a Chapter 13 plan. Most people will give the client a form to fill out and ask them to provide figures for expenses such as electricity, fuel, water, sewer, telephone cost, home maintenance, food, clothing, and so forth. However, they often list these figures without any guidance from the client. In this video, I'm going to show you how to educate your client so that these figures can be correct. What happens if these figures are not correct? One of the main problems it can cause is the plan being rejected by the court, which means the debtor may not be able to stay in the plan. To avoid this, the first thing we need to do is cross-reference the figures provided by the client with the IRS guidelines. Here are three things to keep in mind when doing schedule J: 1. Schedule J should always allow for a budget lasting the length of the Chapter 13 plan, which is normally 3 to 5 years. In other words, you don't want to calculate the figures for just this month. These figures can fluctuate depending on the season, time of the month, or any other time during the year. 2. You should never match the maximum IRS allowance. The IRS guidelines should only be used as a guideline to spot possible errors. Avoid simply inputting the maximum allowances for all schedule J filings. Each petition is unique and should be accurately reflected. 3. Schedule J should assist in documenting allowances that exceed the IRS guidelines. This way, receipts can be obtained for verification purposes. To get the IRS guidelines for your area and clients, you can visit...

Award-winning PDF software

Schedule j Form: What You Should Know

Schedule J: Income Averaging for Farmers — Turbot Ax The U. S. IRS requires that you use one form, Schedule J, to elect to averaged your income. As the first form in the IRS's “Income averaging for farmers” program, Schedule J is used to elect to average your income across the years 2025 and 2025 before electing to use Individual Returns. That is, you must use Schedule J (Form 1040) to estimate your tax for 2013, 2025 and 2025 before you figure it out using IRS Form 1040 for 2025 and beyond. Do not report income on Schedule J before it is reported on Form 1040. Schedule J: Income Averaging for Farmers — Turbot Ax How does Schedule J: Income Averaging Tax for Farmers work? You must report all your income to Schedule J: Income Averaging Tax for Farmers for each of the following 5 tax years: 2 2 Your 2025 income will be averaged on Schedule J, using each year's tax rates. Your 2025 average will be the result of your 2025 and 2025 income averaged on Schedule J. The 2017 total will be adjusted if your 2025 income is less than 2013. The amounts that you report on Schedule J for each of the 5 tax years will include your earnings from income from farming, fishing, and rental property. The earnings reported on Schedule J, and the amount that is deducted from your income on Schedule A, will be multiplied by the tax rate to get your income tax. You'll see that the amount you enter on this schedule, and the amount that is taxable, is dependent on whether you itemize. How to Use Schedule J: Income Averaging Tax for Farmers How to Use Schedule J: Income Averaging Tax for Farmers For 2013: Schedule J is used to elect to average your total 2025 income for the tax years 2025 and 2014. If you've elected to file a joint return, it is used to determine your 2025 income. For 2014: Enter the taxable income from your 2014. Schedule J, line 12. For 2025 and beyond: Schedule J is used to elect to average your total income for 2025 and future tax years.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 990 (Schedule J), steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 990 (Schedule J) online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 990 (Schedule J) by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 990 (Schedule J) from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Schedule j form