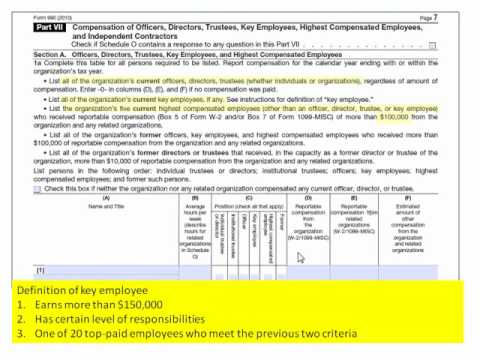

Part seven covers compensation. It includes all of the compensation reported on the nine ninety, which the IRS provided about three years ago. Before this new form came into effect, nonprofits actually reported compensation in two places. They reported compensation for officers, directors, trustees, and key employees within the main body of the form. Then, they reported compensation for the five highest compensated employees who weren't officers, directors, trustees, or key employees on the schedule A. When the IRS revised the 990, they combined all of that information. Now, when you're filling out information for a specific individual, you actually check in column C to determine where they fall. If they're an officer or director or key employee, the threshold for reporting differs. If someone is an officer, director, or trustee (which is basically a member of the board or governance body), they have to be reported in this section, regardless of whether they receive any compensation or not. The same is true of key employees. Key employees are people who are employed by the organization and earn more than $150,000. They have significant responsibilities within the organization, such as running the whole organization or being responsible for a significant portion of the budget. The IRS defines in the instructions what that portion should be. Key employees are also one of the top 20 paid employees who meet the criteria 1 and 2. If all three of those conditions are true, then that person is considered a key employee, and you have to report on all compensation they receive. The five highest compensated employees are people who are not officers, directors, trustees, or key employees but earn more than $100,000 a year. They are reported in this section as well, but only the top five are included. Furthermore, organizations are required to report...

Award-winning PDF software

990 Compensation Form: What You Should Know

Sep 24, 2025 — Form 990 for Small Businesses (SBC) — IRS Sep 7, 2025 — Disclosure of payment to officers and directors of SBS is a required part of an organization's form 990. Sep 7, 2025 — Disclosure of payments to other executives is a form 990-PF optional activity of SBS. Form 990-PF does not allow organizations to disclose any information regarding payments to other executives. The organization may choose to include the payment as part of an annualized income statement, which is a separate report. Sep 25, 2025 — SITES: Disclosure of Pay or Other Compensation to Executive Officers and Directors (Form 990). Sep 11, 2025 — Disclosure of compensation is a required part of an organization's form 990. This form must be filed by the company's president, chief executive officer, or chief financial officer. If the organization is a corporation, it must file Form 8829, or Form 8500, at the same time as Form 990(a). If the organization is a partnership, all partners must file Form 990(a) or 8500, at the same time as Form 990 is filed. Aug 22, 2025 — Form 990-PF — IRS Sep 21, 2025 — Tax on Excess Cash Earned by Executives of Large Firms — SLR Sep 3, 2025 — Payment to the President at Large of FTSE 100 Company — SLR Jul 1, 2025 — Filing Required For the IRS to accept a 1099-MISC or 1099-DIV, the payment must be reported on the Form 990 (Part VII and schedule E) or Form 1040. The Form 1040 must be filed with a separate return and the Form 990 (Part VII and schedule E) must be filed separately but also with a separate return.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 990 (Schedule J), steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 990 (Schedule J) online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 990 (Schedule J) by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 990 (Schedule J) from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing 990 Compensation