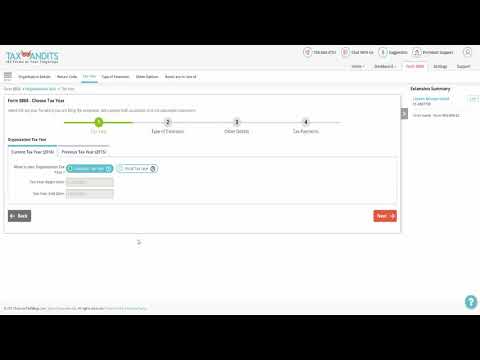

Welcome to Tax Bandits, we simplify tax filing for small businesses and nonprofits. Need more time to file your tax return? No worries, simply file Form 8868 and get six additional months to file. After logging into your account, choose the tax extension Form 8868 to file under forms. Then, enter the organization's name and EIN. Make sure the organization's name and EIN match as per the IRS database. After entering your organization details, click "Next" to continue. Now, choose the appropriate return from the list below to request for the extension, then click "Next". Here, you will select the tax year for which you are filing the extension. Choose if your organization falls under the calendar tax year or fiscal tax year ending on the last day of any month other than December. Tax Bandits then verifies that you will receive an extension for only six months regarding the tax return for the current tax year. The following page requires you to indicate whether you are a foreign organization operating outside of the United States. If this is for a group return, please select the option based on your organization. Then, proceed to provide the organization signing authority and books are in care of details. Tax Bandits will provide a summary of your tax extension for you to review for accuracy. Proceed to review your payment source for the extension, if any. Then, process the service fees for each, funding your extension with the IRS. Provide your credit card details, then review your extension form details if needed. Electronically sign and transmit your tax extension return to the IRS. This video was brought to you by Tax Bandits, helping businesses succeed with online tax preparation.

Award-winning PDF software

990 t Schedule J Instructions Form: What You Should Know

See page 13 of the Schedule C, Real Property Income, for the calculation of rental allowances. Page 13 of Schedule C, Real Property Income, for the calculation of rental allowances. See the Instructions for Schedule C—Rent Income—Individuals, later, for details. Form 990-T—Exempt organizations (2016). Page 2. Schedule M—Net Investment Income—Individuals. (see instructions) Additional Resources to Help You Prepare This Form: Form 990, Part IV, Line 4. See page 1 of the Schedule A, Business Expenses. For the calculation of charitable deductions and expenses required to be shown as itemized deductions on Schedule A, see Pub. 15, Worksheet 3. Line 3, box 1a, is the amount required to be reported on Line 3, Form 941. For each organization to be classified as a social welfare organization, see the instructions to Form 941. These organizations must pay income tax even if their primary purpose is to make contributions to a religious organization. However, these organizations must not reduce their tax by this deduction, and the deduction is not available on income tax withholding from the contributions. See the instructions for line 26, paragraph (b) of Form 941 (or a copy of Form 890–B in the case of a Schedule C return); for the rules with regard to a religious tax-exempt organization's allocation of expenses. Line 3a, box 1b, is the amount required to be reported on line 3, Form 941. This amount includes the income tax deduction. For each organization to be classified as a social welfare organization, see the instructions to Form 941. These organizations must pay income tax even if their primary purpose is to make contributions to a religious organization. However, these organizations must not reduce their tax by this deduction, and the deduction is not available on income tax withholding from the contributions. See the instructions for line 26, paragraph (b) of Form 941 (or a copy of Form 890–B in the case of a Schedule C return); for the rules with regard to a religious tax-exempt organization's allocation of expenses. Line 3b, box 1c, is the amount required to be reported on line 3, Form 941.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 990 (Schedule J), steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 990 (Schedule J) online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 990 (Schedule J) by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 990 (Schedule J) from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing 990 t Schedule J Instructions